NBK ECONOMIC REPORT

KUWAIT: Leading indicators point to an economy growing at a subdued pace but possibly not far off a cyclical upturn. Admittedly, non-oil GDP growth was surprisingly strong in Q1 but this was skewed upwards by a base effect in the oil refining sector. By contrast, consumer spending growth remained soft in Q2 while the PMI gauge of private sector activity similarly slowed in both Q2 and Q3, albeit still indicating firms’ output rising. Project awards and real estate sales were affected by the seasonal lull in Q3, though the signs are that momentum could quicken in the final quarter of the year. An acceleration in bank credit growth in Q3, especially in business lending, was positive for the overall macro picture, and further gains in household and business lending might be expected with the Central Bank of Kuwait having begun its interest rate cutting cycle in September.

Q3 also saw rating agency Fitch re-affirm Kuwait’s sovereign credit rating at AA- with a stable outlook on the back of strong external balances and the sizable reserve assets, though did identify elevated current spending and high oil dependency as risk factors that require structural reform and diversification initiatives to address. More details on these and other measures are expected in the government’s economic framework, expected shortly.

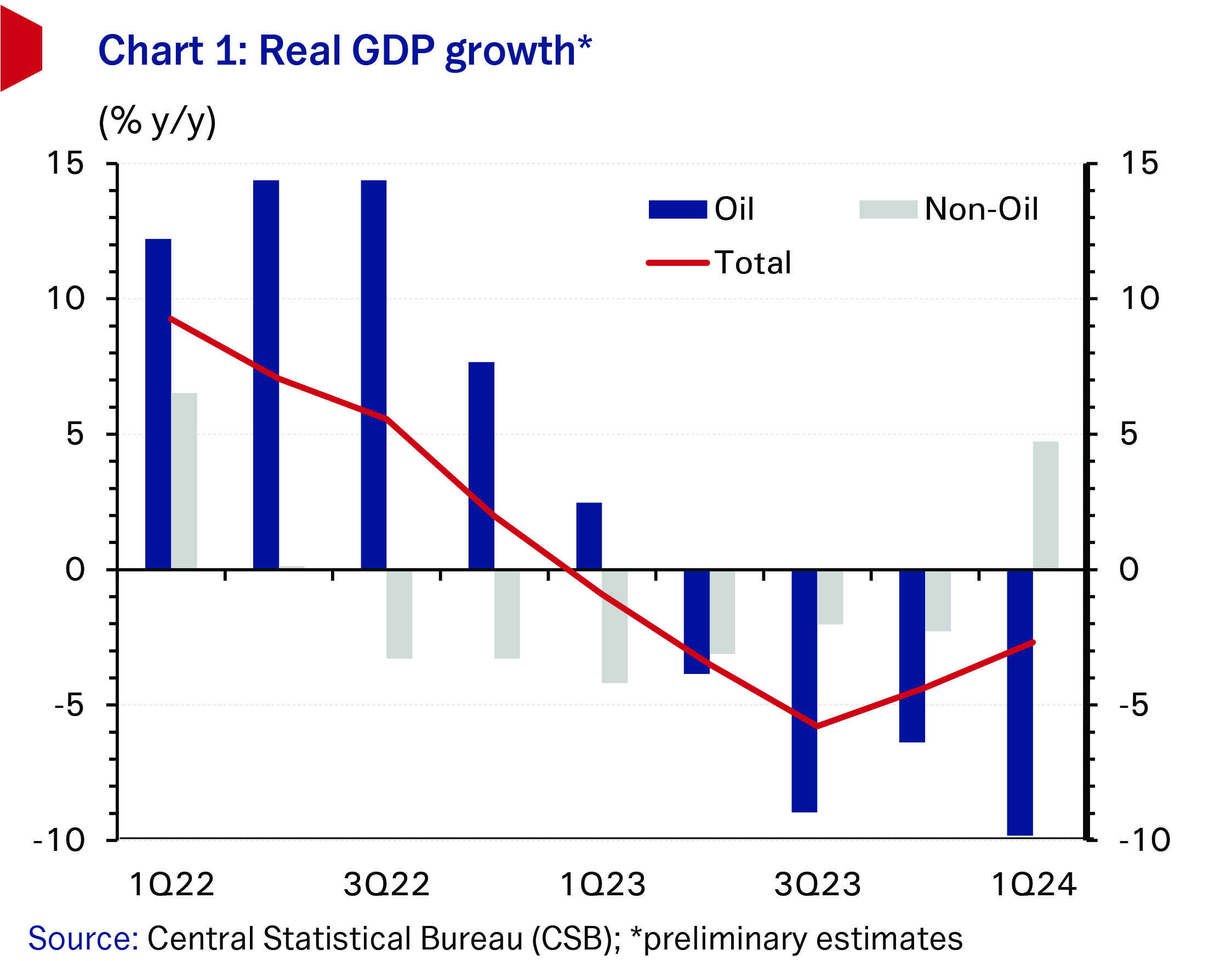

Non-oil GDP growth

Provisional CSB data showed non-oil GDP growth rebounding in Q1 2024 to 4.7 percent y/y from Q4 2023’s contraction (-2.3 percent). The improvement was driven by strong growth in the manufacturing sector (including oil refining), which rose 20 percent compared with a decline of 8.8 percent the previous quarter, and in other services (mostly real estate), which rose almost 7 percent. On the other hand, oil sector GDP saw a steeper decline in Q1 of 9.8 percent compared with -6.4 percent in Q4 2023, reflecting OPEC-led supply cuts. Total GDP growth stood at -2.7 percent, a less steep decline than in Q4 2023 (-4.4 percent).

Oil prices slump in Q3

Oil prices dropped more than 15 percent in Q3 amid China-driven oil demand concerns and worries over excess supplies in Q4 2024 and through 2025. Local marker Kuwait Export Crude (KEC) settled at $74.3/bbl (-15.5 percent q/q) at September’s end, while Brent futures closed lower at $71.8/bbl (-16.9 percent q/q). OPEC+’s decision in September to delay unwinding 2024’s voluntary supply cuts (of 2.2 mb/d) by two months to December did little to arrest the decline. By the close of Q3 and through early October, prices began to respond positively as the Gaza-Israel conflict spilled over into Lebanon, drawing in Hezbollah and Iran (Brent touched $74/bbl on 3 October).Current market fundamentals point to sizeable stock builds in 2025, but Saudi Arabia has hinted that it may not backstop price falls anymore by withholding supply while several OPEC+ members flout quotas and fail to honor their compensatory cut obligations.

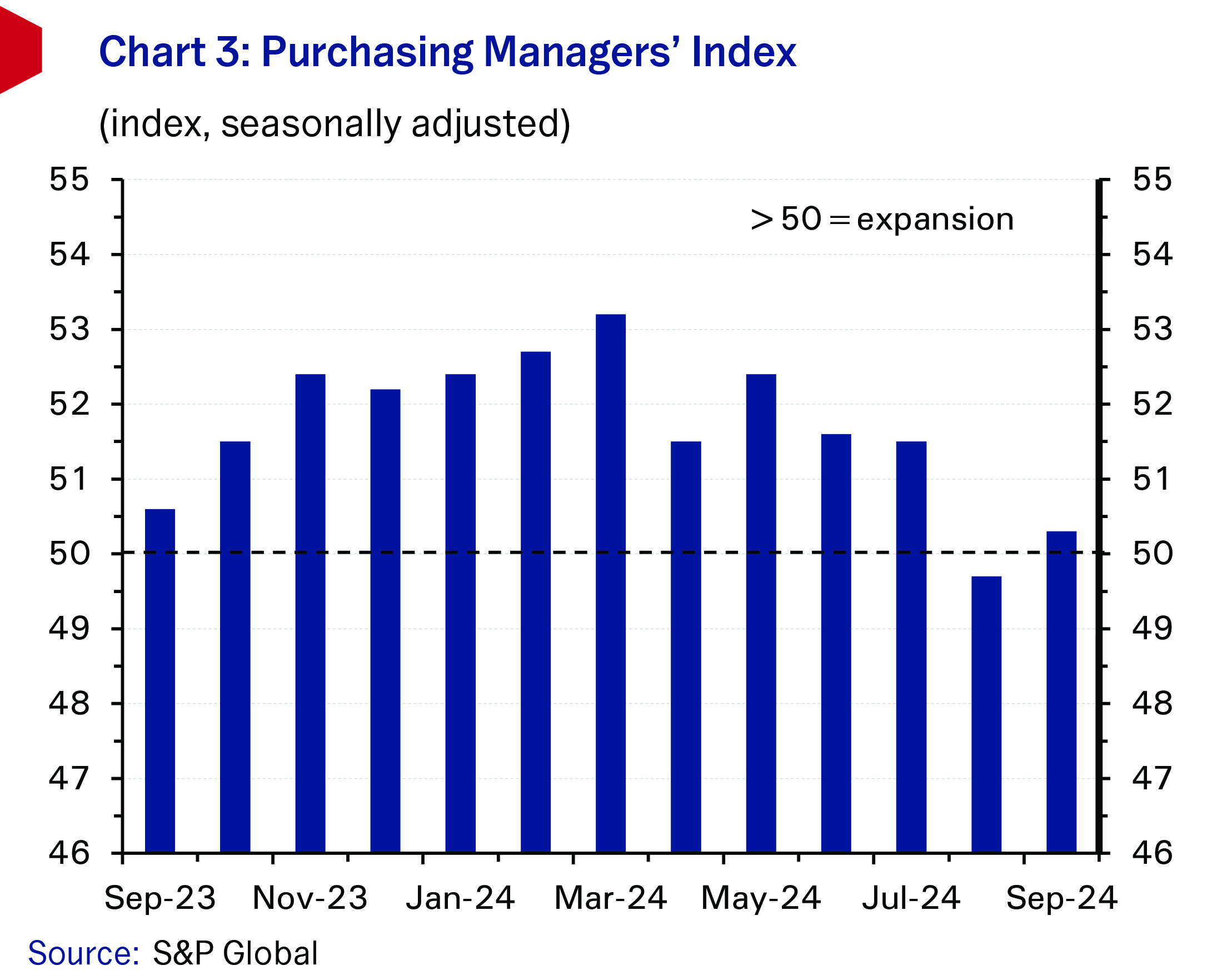

Kuwait, for its part, held crude production steady through both Q2 and Q3 at 2.41 mb/d. Output of refined products, however, surged to a record high (1.39 mb/d) as more crude destined for export markets was diverted to local refineries to satisfy European and Far Eastern demand for gasoil and low Sulfur fuel oil. In fact, refined products exports exceeded crude exports for the first time ever in both volume and value terms in Q2, a significant milestone. Looking ahead, as per the OPEC+ production schedule, Kuwait’s output could rise by 135 kb/d to 2.55 mb/d by the close of 2025.

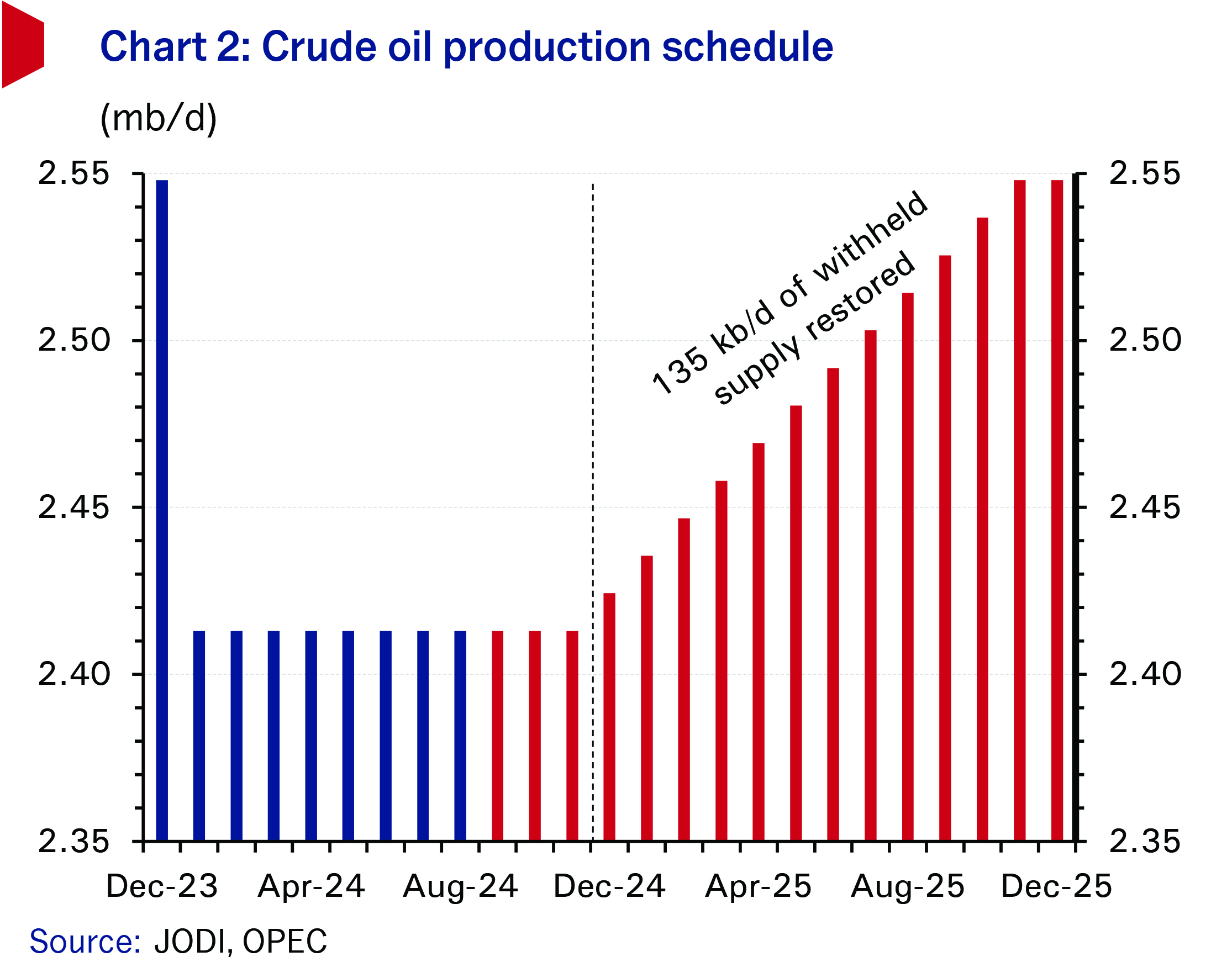

Non-oil private sector activity continued to slow in Q3, with the headline PMI ending the quarter lower at 50.3 compared to the reading of 51.6 at the end of Q2. Activity also briefly dropped below the 50 no-change index level in August. Nevertheless, growth in output, new orders and employment, the three largest components of the PMI, has visibly slowed through 2024 amid softer local and external demand conditions, as has the output price inflation component of the PMI data. Firms remain optimistic about year-ahead prospects, though.

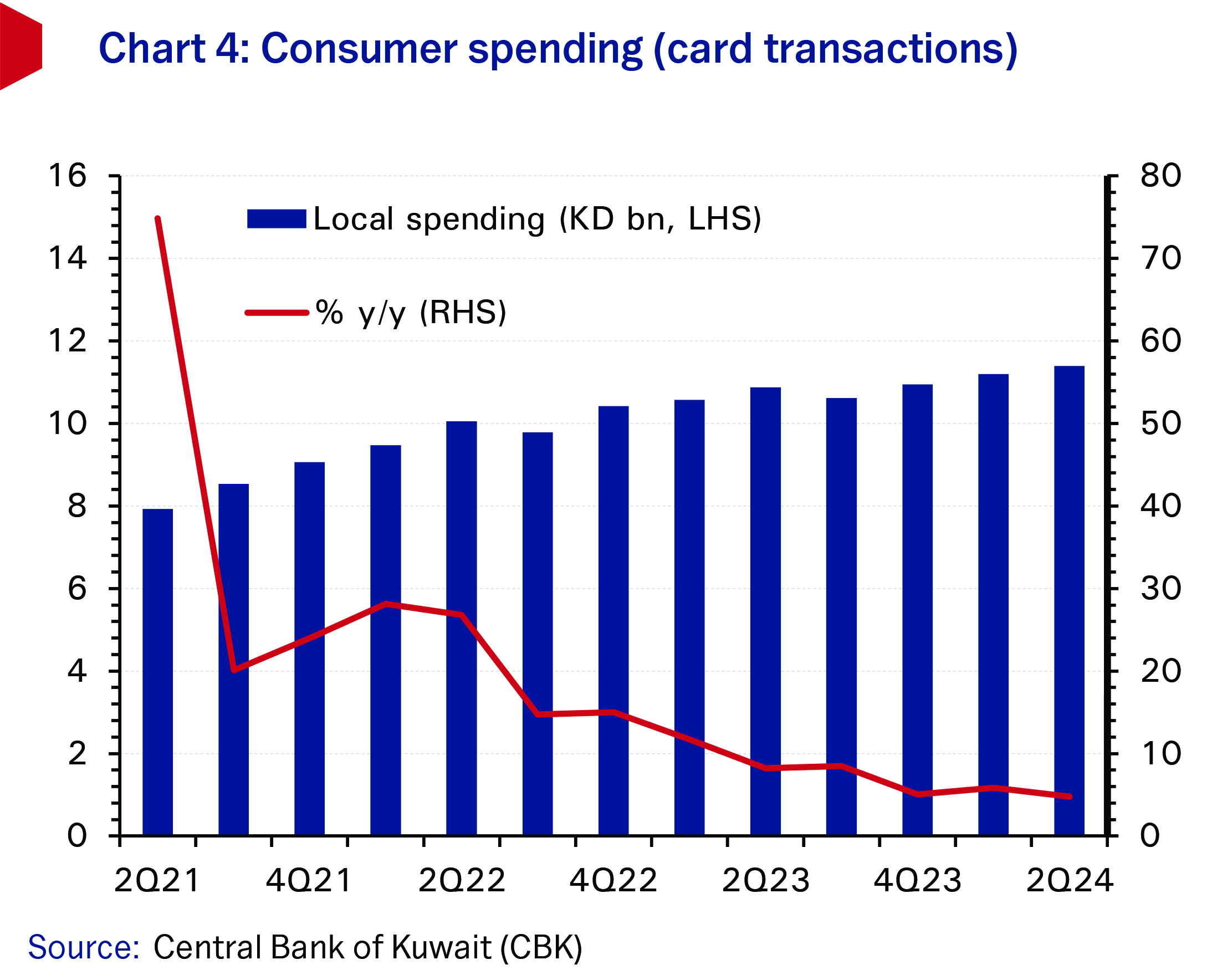

Consumer spending growth

Cards data for Q2 confirmed the now three-year long moderation in consumer spending growth. Growth in local spending eased to 4.8 percent y/y from Q1’s pick-up to 5.9 percent. This is the slowest rate of growth in local spending since the height of the pandemic in Q2 2020. In contrast, spending abroad accelerated by 17 percent. In total, card spending rose by 5.4 percent to KD 12.1 billion.

Real estate activity slips in Q3

Property sales declined by 0.8 percent q/q in Q3 2024 to KD 847 million, largely on a fall in commercial sales (-50 percent q/q) from Q2’s strong performance. Sales were up almost 25 percent y/y in Q3 (46 percent y/y in Sept), however. The residential property sector logged its best quarterly growth rate since Q2 2021 at 14 percent q/q (8.2 percent y/y) to reach KD 384 million. Investment sales also witnessed strong growth during the quarter at 42 percent q/q to KD 317.1 million. Looking ahead, ongoing sluggishness in the residential segment highlights supply shortages, high valuations and weak demand challenges. However, lower borrowing costs could support demand going forward as the new government looks to stimulate the market.

Project activity momentum eases in Q3

Project activity remained fairly solid in Q3, relative to recent years, with the value of awarded projects coming in at KD 580 million. In line with the seasonal trend, activity fell 19 percent q/q (-16 percent y/y) but Q2 was a strong quarter.

The power & water sector was the most active in terms of awards in Q3, accounting for three quarters of total market activity. The Ministry of Electricity and Water pressed ahead with tenders to develop and upgrade existing substations including Doha and Subiya. The near-term outlook remains solid, with activity likely to pick up in the power & water, construction and energy sectors in line with government development plan priorities. MEED Projects has penciled in KD 3.3 billion worth of awards for Q4 2024 and a further KD 5.3 billion in H1 2025.

Inflation softens

CPI inflation in August softened only fractionally to 2.9 percent y/y from 3.0 percent in June and July. Inflation in the food & beverages (+6.0 percent) and miscellaneous (+5.3 percent) categories has been especially persistent and was substantially higher in August than at the start of the year. Core inflation, which excludes food and housing, edged up to 3.2 percent in August (July 3.1 percent), spurred by price rises for clothing (+5.8 percent) as well as the miscellaneous component. Nevertheless, inflation is expected to continue to trend lower and remains on track for an average annual increase of 3.0 percent from 3.6 percent in 2023.

Population growth rate slows

The latest PACI data showed that Kuwait’s population reached 4.92 million as of June, growing by a slower 2.0 percent y/y compared to the 2.6 percent recorded at end-2023. Outside of the COVID-19 pandemic years, when expatriate numbers fell significantly, this is the slowest rate of growth since 2017. The Kuwaiti population increased by 1.9 percent to 1.56 million and the expat population by 2.0 percent to 3.36 million, pushing up the share of the latter fractionally to 68.3 percent. However, the population is still more than 0.5 million smaller than it would have been had pre-pandemic growth rates been maintained. Meanwhile, growth in total employment almost halved to 2.7 percent y/y in June from 5.0 percent at the end of 2023, on the back of slowing expatriate employment growth (+2.6 percent y/y). Kuwaiti employment gains were stronger at 3.2 percent, though again these were predominantly public sector-led; private sector employment continued to decline.

Domestic credit growth continued to strengthen, standing at a relatively decent 2.2 percent YTD through August (+3.5 percent y/y). Business credit growth has been stronger than household, improving to 3.2 percent YTD (+3.8 percent y/y), buoyed by a solid August. The construction and trade sectors remained in the lead, in line with 2022-2023, up 15 percent and 8.1 percent YTD, respectively. The last four months have showed some recovery in household credit, with an annualized growth of 4.1 percent over that period while the y/y increase remains a limited 2.4 percent. Looking ahead, lower interest rates should support credit growth, but Q4 is historically weak for business credit. The nascent recovery in household credit can be sustained, however.

Similarly, resident deposits stood higher by August end (+2.6 percent ytd; +5.1 percent y/y), supported by private-sector deposits (+3.6 percent ytd) and government deposits (+9.8 percent ytd) while public-institution deposits were down (-8.1 percent ytd) despite posting two consecutive months of gains.

Monetary easing cycle

Following the US Fed’s lead, the Central Bank of Kuwait (CBK) loosened monetary policy in September, cutting its benchmark discount rate by 25 bps to 4.0 percent. In a continuation of its more measured approach to rate changes, the CBK cut by less than the 50 bps of the Fed and other GCC central banks. The CBK explained that its decision was informed by local and international economic developments, banking and monetary conditions as well as local consumer price inflation.