NBK INTERNATIONAL REPORTGlobal monetary easing ramps up as US focus shifts to labor market

KUWAIT: With inflation edging down closer towards targeted levels, key central banks have shifted their focus away from rising prices and towards protecting the economic growth outlook and warding off any recession threat. For now, the outlook for a soft landing in the US looks promising, with the labor market still quite solid and the Fed set to start cutting rates in September. In the eurozone, the ECB is set to lower rates again in September against a backdrop of softer though still positive economic growth but still-elevated services inflation. In Japan, the BoJ faces a difficult balancing act as its pursuit of higher interest rates at a time of cuts overseas risks a further bout of financial market instability. Finally, economic indicators in China are weakening, but the authorities are yet to offer forceful policy support.

Fed to start cutting rates

US GDP growth rebounded strongly to 3 percent (annualized) in Q2 from 1.4 percent in Q1, and leading indicators point to another decent 2 percent rise in Q3. Private consumption was particularly strong in Q2 (2.9 percent from 1.5 percent in Q1) and July’s solid retail sales (+1 percent m/m) suggests still-resilient consumer activity.

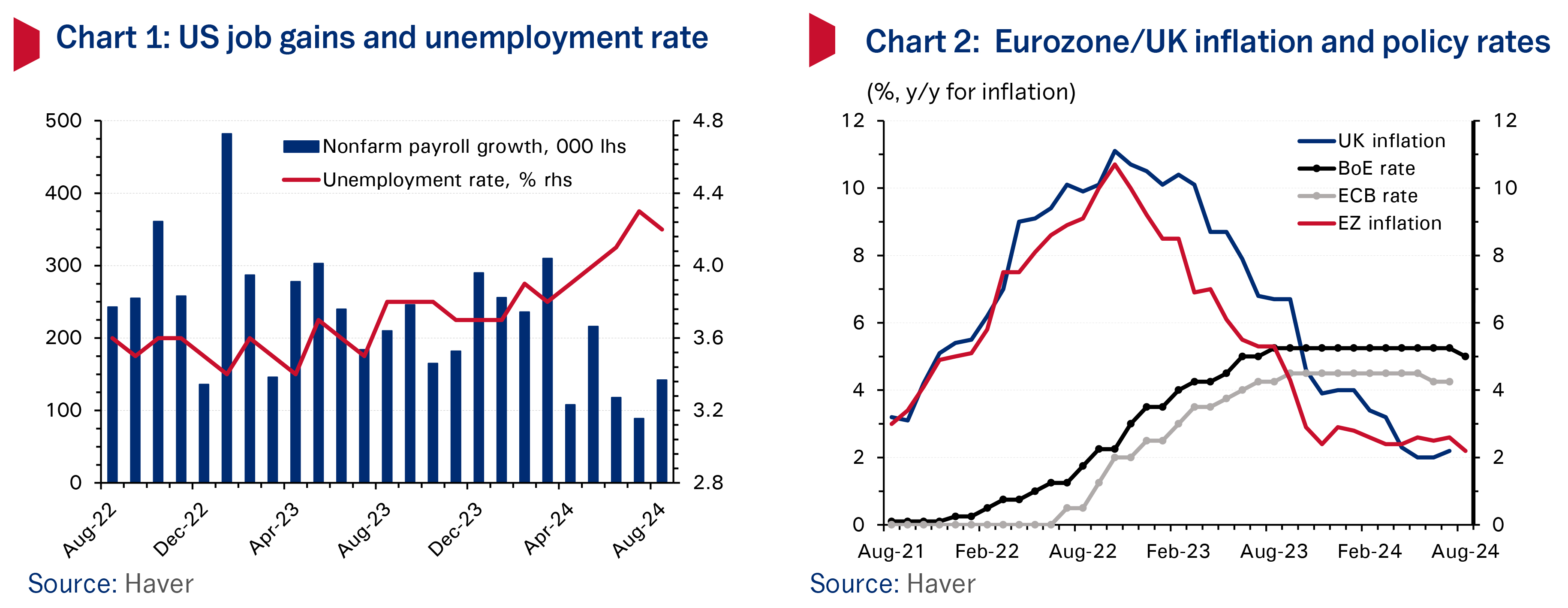

In contrast, real estate activity is weak, manufacturing continues to shrink, and the ISM services index remains on a general downtrend and is only marginally above 50. Moreover, the labor market continued to gradually weaken as indicated by data on job growth, job vacancies, and the unemployment rate. For example, rolling three-month average job gains fell to 116K/month in August, the weakest since the onset of the pandemic, and the unemployment rate rose by an eye-catching 70 bps since July 2023 to stand at 4.2 percent in August 2024.

On the other hand, consumer price pressures continue to abate, with July’s PCE inflation down to 2.5 percent y/y and core to 2.6 percent (versus 4.2 percent one year ago), inching closer to the 2 percent target and pushing the Fed to switch focus to its other mandate, i.e. maximum employment.

The Fed is near certain to start an easing cycle in mid-September, delivering a 25 bps interest rate cut although an outsized 50 bps cut is not completely off the table. The futures market is currently indicating a cumulative 100-125 bps in cuts by year-end, although this carries a high degree of uncertainty. The overriding question continues to be whether a hard landing for the US economy can be avoided or not, and contrary to historical precedent at a time of sharp monetary tightening, a hard landing still looks, for now, avoidable.

Meanwhile, the presidential race is looking to be a very tight one, keeping financial markets on edge until election day. A Harris win will likely result in minor variations to Democrats’ current policy and plans, while a Trump win will inject a more pro-business edge (through lower taxes and regulations), but also extra unpredictability to US policy in terms of trade, immigration and global geopolitics, with far-reaching implications on the economic outlook.

ECB to cut rates again

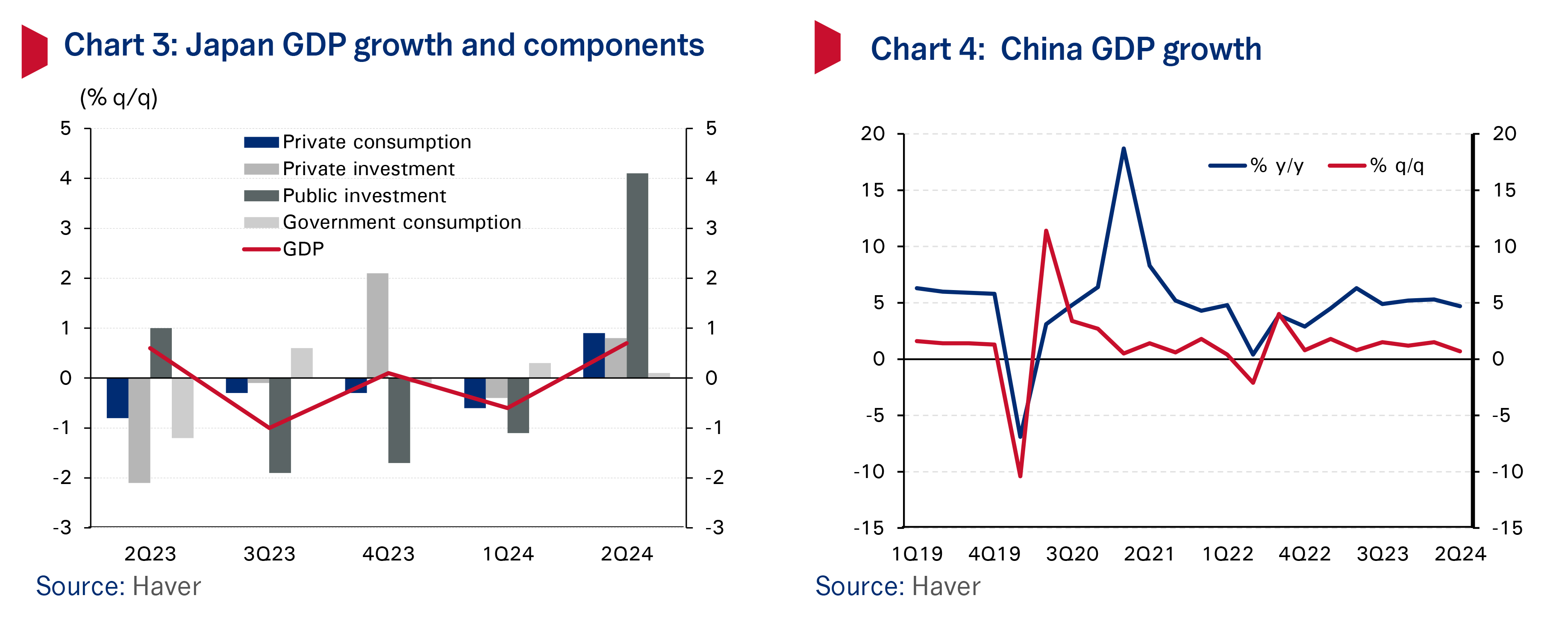

By contrast, the eurozone economy managed only moderate GDP growth of 0.2 percent q/q in Q2, slightly below the 0.3 percent recorded in Q1. The service sector continues to lead the recovery with the services PMI rising in August to 52.9, a three-month high, helped by the Paris Olympics, while the manufacturing PMI remained, now for two years, in contraction territory. Trade conditions remain vulnerable given tensions with China, posing risks especially to export-heavy Germany. On a more positive note, consumer price inflation fell to 2.2 percent y/y in August from a 2.4-2.6 percent range in the previous six months, the softest rise in around three years.

However, core inflation remained relatively sticky at 2.8 percent y/y in August, with services inflation rising to a 10-month high of 4.2 percent. The recent data and outlook on inflation and growth have strengthened the market’s expectation of another 25bps interest rate cut by the ECB, which now seems likely, at its upcoming September 12 meeting, following a first 25bps cut in June.

In the UK, the economic recovery picked up steam, with GDP growth at a robust 0.6 percent q/q in Q2, following a solid 0.7 percent rise in Q1. Moreover, the Bank of England (BoE) recently upgraded the 2024 growth forecast to 1.2 percent from 0.5 percent earlier. Recent PMI activity indicators were strong, with the services index rising to a four-month high of 53.7 in August while manufacturing hit a two-year high of 52.5. Still, sustaining this growth momentum over coming quarters will be challenging given still-elevated interest rates, fiscal tightening and a looser labor market. Meanwhile, core inflation decelerated to a 34-month low of 3.3 percent y/y in August and headline inflation has been in a 2.0 percent-2.2 percent range since May. The BoE cut its policy rate in July by 25 bps to 5 percent, but struck a cautious stance about future rate cuts due to still-elevated services inflation (5.2 percent in July) and high but softening wage growth (5.1 percent y/y in the three months to July). Following a landslide victory by the Labour Party in the July election, new PM Kier Starmer has pledged to boost growth. But the new administration faces a stretched fiscal position and is looking to plug a disguised fiscal hole (£22 billion, or 0.8 percent of GDP) allegedly inherited from the previous government. It will spell out details of “painful” required fiscal measures in its late October budget.

BoJ eyes policy normalization

The Bank of Japan (BoJ) hiked, in late July, its key interest rate to “around 0.25 percent” from a range of 0 percent to 0.1 percent and pledged to halve its monthly bond purchases by Q1 2026, in a move towards normalizing its ultra-loose monetary policy. The hawkish BoJ decisions, coupled with US recession fears after a poor July jobs report, triggered extreme volatility in Japanese and global financial markets, including a near 20 percent crash in Japanese stocks across just two days, as so-called ‘carry trade’ investments were unwound amid a surging yen. This prompted BoJ officials to announce that they will not be raising interest rates if “financial markets are in an unstable state”, which has helped restore relative calm in financial markets for now. Recent growth data was relatively robust, with GDP increasing 0.7 percent q/q in Q2, the fastest since Q1 2023, more than reversing Q1’s 0.6 percent contraction with private consumption rising following April’s wage increases. Leading indicators suggest that the strength could somehow continue in Q3, with the composite PMI climbing in August to the highest since May 2023. Inflation stood at 2.8 percent y/y in July, steady for the third straight month but above target, while core inflation ticked up to 2.7 percent. Overall, the current economic trajectory is allowing the BoJ to remain committed to gradual policy normalization, potentially delivering another interest rate hike either this October or in January 2025.

China outlook weak

The Chinese economy grew a softer-than-expected 4.7 percent y/y in Q2, below market estimates and the 5.3 percent recorded in Q1. Early Q3 indicators remain lackluster, suggesting slowing economic momentum. Specifically, July showed softening y/y growth in industrial production, fixed asset investment and credit. Moreover, growing international trade disputes have exerted renewed pressure on the export outlook, with Europe and Canada joining the US in imposing additional tariffs on some China-made products. While retail sales showed some improvement in July, growth is still significantly below the pre-COVID trend. In addition, consumer price inflation was a modest 0.6 percent y/y in August while wholesale prices have been in deflation for nearly two years. Finally, the unemployment rate ticked up to 5.2 percent in July with youth unemployment spiking while the general PMI for August (50.1) is the lowest since December 2022. On the policy front, the central bank cut interest rates on several policy instruments by 10-20 bps in July, but kept them steady in August. The soft economic outlook, including ongoing property sector woes and an uncertain global backdrop, require more forceful and broad-based stimulus measures that have been unforthcoming so far. Hence, the government’s “around 5 percent” growth target for 2024 is looking optimistic.

India’s strong growth trajectory

India’s economic growth slowed to 6.7 percent y/y in Q1 FY2024-25 from a solid 7.8 percent the previous quarter on a sharp slowdown in government expenditure owing to elections during the quarter. However, underlying activity remained strong, with private consumption growth rising to a seven-quarter high of 7.6 percent from 4.3 percent in the previous quarter. Moreover, with monsoon rains being above-normal so far this season, agricultural production, and consequently, rural consumption is likely to pick up further, boosting growth prospects for the remainder of the current fiscal year (expected at around 7 percent). Meanwhile, inflation fell to a nearly five-year low of 3.5 percent y/y in July from 5.1 percent in June, mainly due to base effects, but will likely pick up as food price rises continue to be elevated on a monthly basis. As a result, the central bank has maintained its cautious stance, keeping the repo rate steady for the ninth consecutive time at 6.5 percent in August. On the political front, Narendra Modi took the PM office for the third straight time, albeit with a lower parliamentary majority than his previous two terms. The ruling party’s fewer seats in parliament has already resulted in the government back-tracking on several items of its agenda, such as the proposed pension reforms, switching back to a defined-benefits mechanism, in addition to cancelling the overhauling of a capital gains tax mechanism.